Child Tax Credit 2014 Changes – WASHINGTON — A plan to temporarily expand the child tax credit and revive tax breaks for businesses received overwhelming bipartisan support in a committee vote last week, a rare moment of compromise . The leaders of the tax-writing committees in Congress announced a $78 billion bipartisan tax policy deal on Tuesday, including an expansion of the child tax credit. As I reported last week, the .

Child Tax Credit 2014 Changes

Source : david476.substack.com

T08 0088 Major Individual Income Tax Elements of H.R. 6049, The

Source : www.taxpolicycenter.org

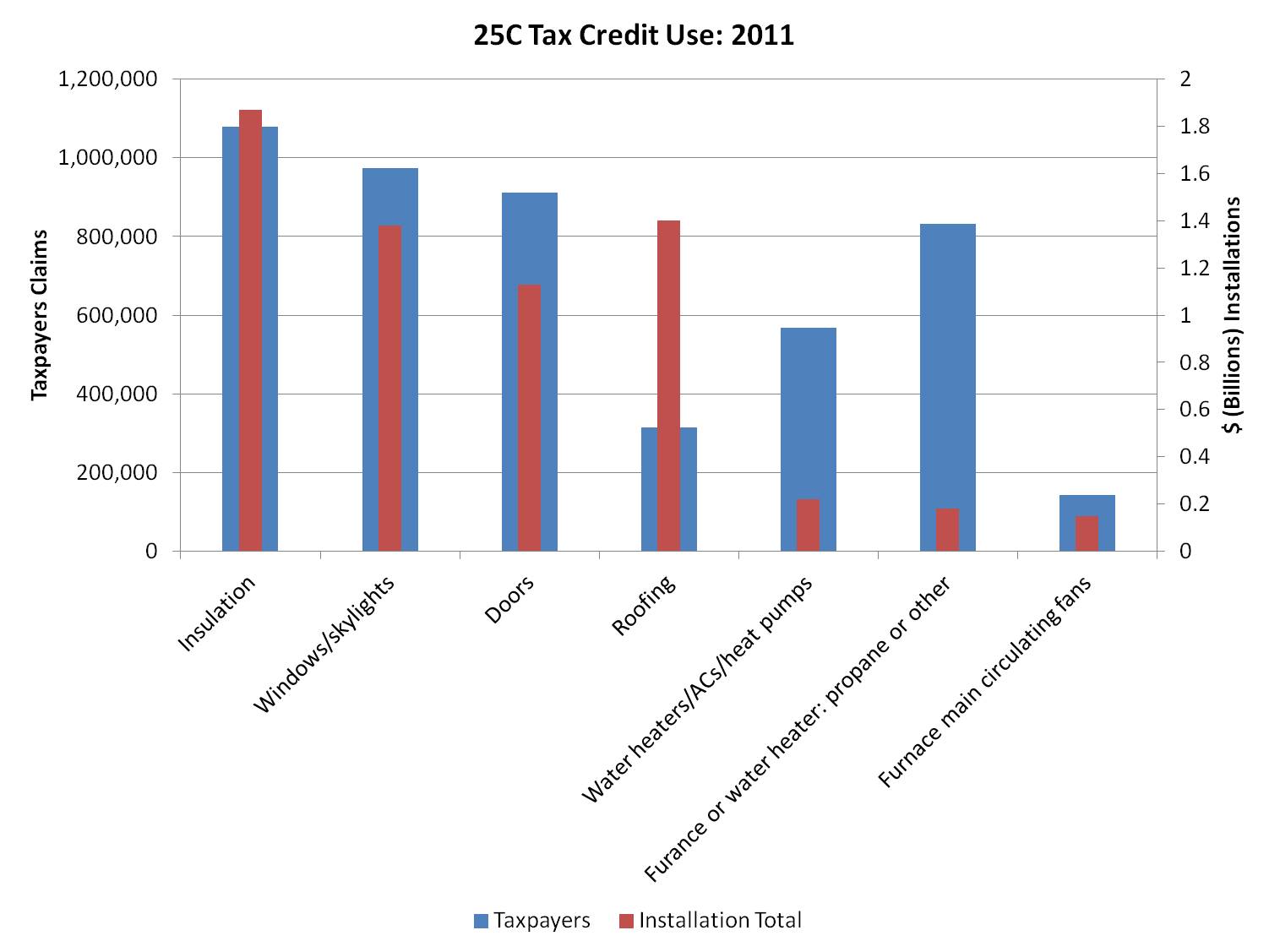

Energy Tax Credits: Large Impacts After 2010 Rule Changes | Eye On

Source : eyeonhousing.org

TPC Updates Analysis of Ted Cruz’s Tax Proposal To Reflect a

Source : www.taxpolicycenter.org

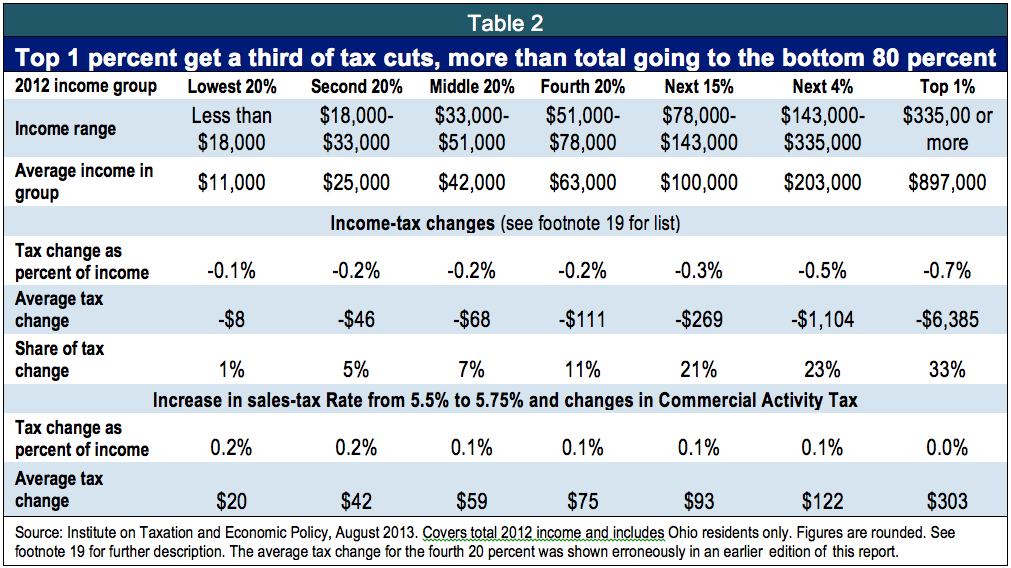

Overview: Ohio’s 2014 15 Budget

Source : www.policymattersohio.org

15 INF 01 Changes in the Earned Income Tax Credit (EITC) and

Source : otda.ny.gov

Energy Tax Credits: Large Impacts After 2010 Rule Changes | Eye On

Source : eyeonhousing.org

How Tax Code Changes Could Affect Oklahomans

Source : www.news9.com

united states How to make sense of results from the IRS W 4

Source : money.stackexchange.com

The Tax Reform Act of 2014 UNT Digital Library

Source : digital.library.unt.edu

Child Tax Credit 2014 Changes We should still means test income support programs: The changes to the child tax credit will primarily target low-income families, but the deal does not increase the credit amount dramatically or disburse it in monthly payments—two key expansions . The changes to the child tax credit will primarily target low-income families, but the deal does not increase the credit amount dramatically or disburse it in monthly payments—two key expansions from .