Child Tax Credit 2024 Phase Out Amount – You may be eligible for a child tax credit payment — in addition to the federal amount — if you live in one of these states. . Fortunately, the government provides the ACTC, allowing up to $1,600 per child ($1,700 for tax year 2024 $2,500 or the amount of the Child Tax Credit that’s left over, whichever is less. In either .

Child Tax Credit 2024 Phase Out Amount

Source : itep.org

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

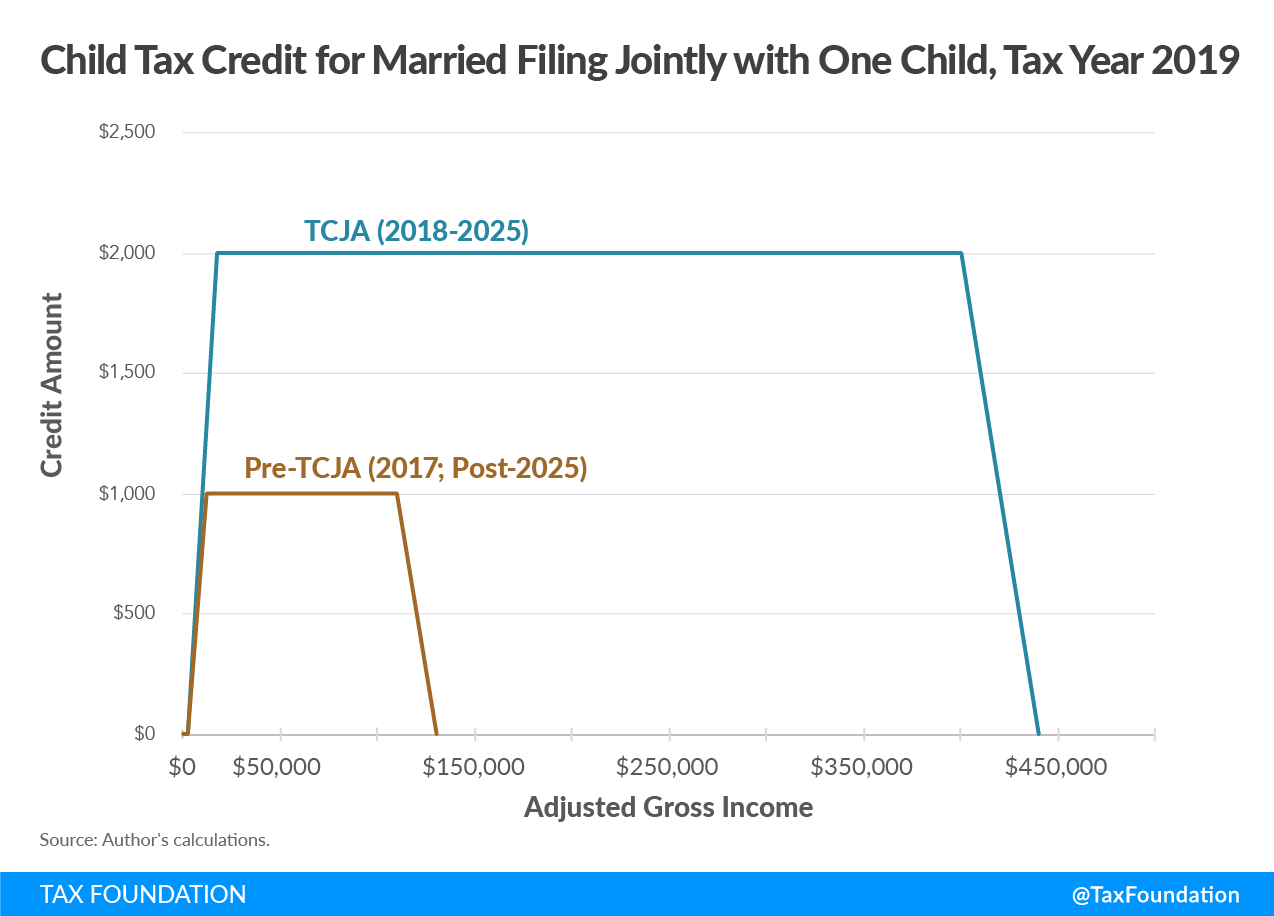

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Child Tax Credit 2024 Phase Out Amount States are Boosting Economic Security with Child Tax Credits in : What to expect for 2024 qualifications and amounts for these credits and deductions can change from year to year. While you might already know about the 2023 child tax credit and other . A bipartisan tax deal aims to expand the child tax credit and restore business deductions for tax year 2023. But it still needs to get passed. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)