Tax Relief Act 2024 Update Details – Taxpayers are expecting relief from the upcoming Interim Budget 2024. As the Lok Income tax section 80c along with 10 tax-saving options are explained here briefly. Section 80C, a provision under . I’ve put together the guide below to walk you through the steps of filing your taxes and discuss the latest updates 2024 should assess the modifications introduced by the Inflation Reduction .

Tax Relief Act 2024 Update Details

Source : accountants.intuit.com

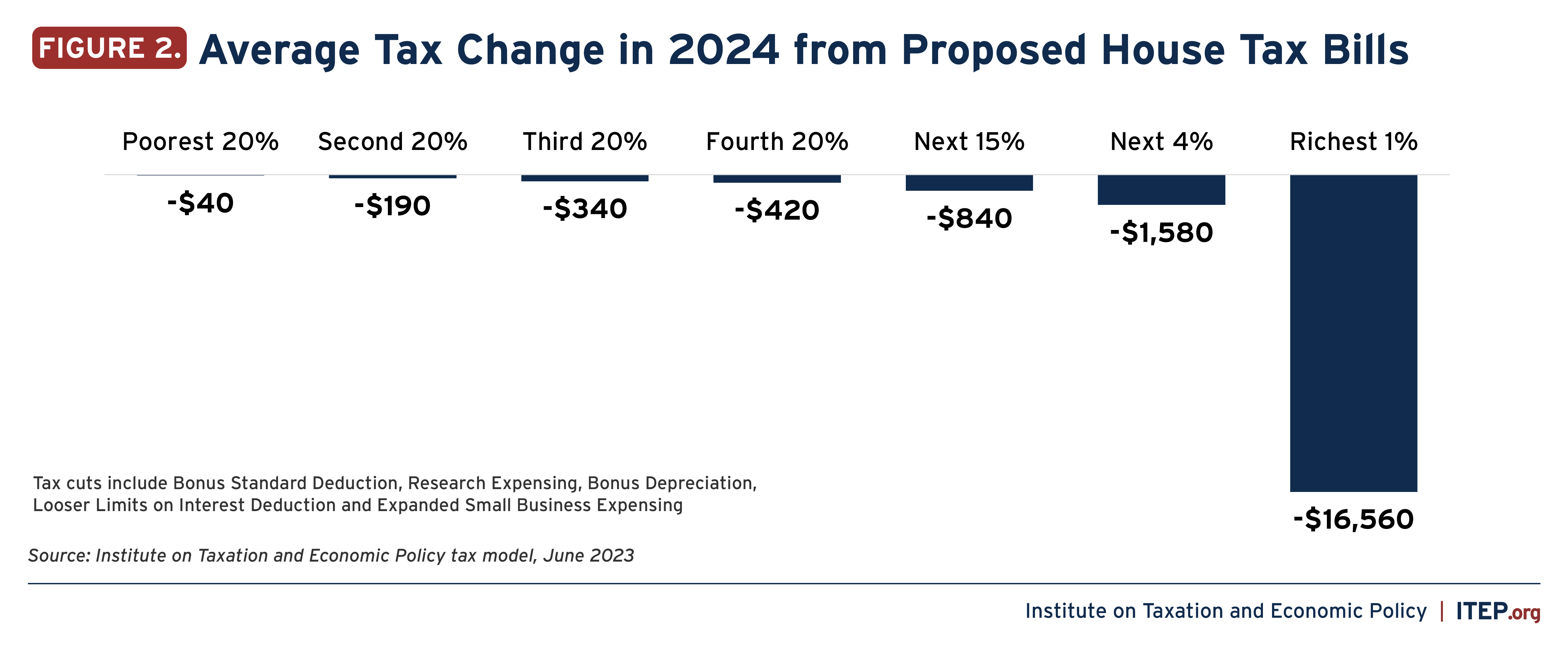

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org

Hawkins Ash CPAs | La Crosse WI

Source : www.facebook.com

Municipal Priorities | Vermont League of Cities and Towns

Source : www.vlct.org

Governor Jim Justice on X: “We’ve cut taxes 23 times since I took

Source : twitter.com

Lower Your Taxes BIG TIME! 2023 2024: by: Sandy Botkin

Source : redshelf.com

Section 179 Tax Deduction for 2024 | Section179.Org

Source : www.section179.org

Irish Farmers Handbook | Carrick on Suir

Source : m.facebook.com

Tax Season 2024: What You Need to Know Ramsey

Source : www.ramseysolutions.com

Tax and payroll reminders for the 2024 new year | UCnet

Source : ucnet.universityofcalifornia.edu

Tax Relief Act 2024 Update Details Tax Pro Center | Intuit | Tax Pro Center: In October, Gov. Maura Healey signed a $1 billion tax relief package designed to benefit renters, caregivers, and seniors. The law went into effect when it was signed, but with residents poised to . We analyzed 11 tax relief companies and selected the top three, based on product and process details, transparency, customer service and business history. .